what is stamp duty malaysia

The stamp duty rate will depend on factors such as the value of the property if it is your primary residence and your residency status. For First RM100000 RM100000 Stamp duty Fee 2.

Stamp Duty Exemption In Malaysia Jr Ng Chin Jc Law

Stamp Duty Calculation Malaysia 2020 And Stamp Duty Malaysia Exemption.

. Stamp duty is a property transaction tax that came into effect in 1694. This means that for a property at a purchase price of RM300000 the stamp duty will be RM5000. Stamp duty is a tax on a property transaction that is charged by each state and territory the amounts can and do vary.

Rubber stamps online Malaysia offers a wide range of rubber stamps Trodat self-inking stamps pre-inked stamps flash stamps multi-color Stamps common seal. ACT payable within 28 days of settlement purchasers must pay stamp duty within 14 days of receiving a Notice of Assessment from Access Canberra. Calculate now and get free quotation.

How much is the first home buyer duty concession worth. First-time homebuyers will get a stamp duty exemption on the instrument of transfer and loan agreement under the Keluarga Malaysia Home Ownership Initiative i-MILIKI says Datuk. The stamp duty is free if.

But remember if you are a first home buyer many States and Territories offer. The stamp duty for the SPA is only RM10 per copy while the stamp duty for MOT and DOA is calculated according to a fee structure of 1 to 4. Stamp duty works differently in each nation in the United Kingdom.

RM100001 To RM300000 RM400000 Total stamp duty must pay is RM500000 So this is the total stamp duty then you can add legal fees disbursement fees valuation fees and other fees to estimate how much the cost of buying the house. In Wales it is known as land transaction tax whereas its called. C 1132 C 172 shipping.

As such the government has made it a compulsory tax-paying when buying or transferring a house in Malaysia. Stamp duty is chargeable on instruments and not on transactions. The surcharge applies to non-resident buyers regardless of the type of buyer eg.

This Stamp Duty on MOT Calculator Stamp Duty Calculator Malaysia helps to estimate the total amount of Stamp Duty on MOT need to be paid. Yonhap news articles produced by building a network covering domestic supplies in various newspapers broadcasting and government departments major institutions major corporations media K-pop K-wave Hallyu Korean Wave Korean pop Korean pop culture Korean culture Korean idol Korean movies Internet media and international agreements of the Republic of. Company or individual subject to very few exceptions for collective investment vehicles such as REITs.

1957 Canada Registered Airmail Cover Eskimo Hunter Kayak Stamp SC 370 351. The state government has a general rate of stamp duty which applies to investment property. When purchasing non-residential property in England or Wales you are still obliged to pay Stamp Duty Land Tax SDLT - a tax levied on property transactions and payable to Inland Revenue - on non-residential assets above the value of 150000 as it currently stands.

KUALA LUMPUR Oct 7. An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. Whats the point of stamp duty.

Read more about House Purchase in Malaysia. Since the concession is calculated on a sliding scale the closer the property value is to 600001 the. If a transaction can be effected without creating an instrument of transfer no duty is payable.

When the instruments are executed outside Malaysia they. Heres your guide to when a stamp duty tax deduction applies. Calculate Stamp Duty Legal Fees for property sales purchase mortgage loan refinance in Malaysia.

The stamp duty fee for the first RM100000 will be 1000001 RM1000 The stamp duty fee for the remaining amount will be 300000-1000012 RM4000. Buyers will be sent this in an email sometime. The stamp duty is free if the annual rental is below RM2400.

Initially it was introduced as a way to raise funds for the war against France and has been a big expense of buying a property ever since. Stamp Duty applies when you buy a freehold property buy a new or existing leasehold buy property through a shared ownership scheme or are transferred property in exchange for payment. Lot of Postal Covers Envelopes Canada USA 1980s to 2000s.

Stamp duty Fee 1. Instruments executed in Malaysia which are chargeable with duty must be stamped within 30 days from the date of execution. The stamp duty for a tenancy agreement in Malaysia is calculated as the following.

Stamp duty fees are typically paid by the buyer not the seller. Calculate the stamp duty you may have to pay on your property using our tool. Its calculated on a sliding scale so the more expensive the property the more stamp duty youll pay.

When do you have to pay stamp duty. From 1st April 2021 a 2 stamp duty surcharge was introduced for overseas buyers on the purchase of residential property in England and Northern Ireland. Meaning loan stocks and shares of public companies listed on the Bursa Malaysia Berhad shares of other companies and of non-tangible property eg.

Some Stamp duty is paid fully by buyer and some are shared between buyer and seller and some are fully covered by Developer different situation will be different. Heavy Duty Professional Text Stamp 8 Micro Printy Text Stamp 2 Multi Color Text Stamp 22 Pen Text Stamp 3 Cloth Marker Stamp 1 DIY Stamp 5. Some examples of documents where stamp duties are applicable include your Tenancy Agreement Instrument of Transfer and Loan Agreements.

Stamp Duty is revenue to the state and the federal government to run or operate the state or our country. A revenue stamp tax stamp duty stamp or fiscal stamp is a usually adhesive label used to designate collected taxes or fees on documents tobacco alcoholic drinks drugs and medicines playing cards hunting licenses firearm registration and many other thingsTypically businesses purchase the stamps from the government thereby paying the tax and attach them to taxed. Can owner-occupiers claim stamp duty.

Just as the stamp duty rate varies from state to state so does the timeframe in which people need to pay it. Unfortunately home buyers who plan to live in the property they buy cannot claim stamp duty as a tax deduction. Stamp Duty Land Tax SDLT is paid when you purchase property or land over a certain price in England and Northern Ireland.

Its worth noting that this is a separate scheme from the First Home Owner Grant FHOG which is a lump-sum payment whereas the first home buyer duty exemption and concession reduces the amount of stamp duty you pay. While the Real Estate and Housing Developers Association Rehda applauds the measure of increased stamp duty exemption to 75 from 50 for residential properties priced RM500001 to RM1 million for first-time homebuyers it hopes that the measure can be extended to all homebuyersIn the press statement Rehda said the. 1-year tenancy agreement RM1 for every RM250 of the annual rental above RM2400.

However what you plan to do with the property also affects the amount youll pay. Home Malaysia Law Firm Malaysia Law Statutes Legal Fee Stamp Duty for Sale Purchase Agreement Loan. Stamp duty is a tax on legal documents in Malaysia.

Tenancy agreement between 1 to 3 years RM2 for every RM250 of the annual rent above RM2400. Do I need to pay stamp duty on non-residential property. The calculation formula for Legal Fee Stamp Duty is fixed as they are governed by law.

Stamp duty is the tax you pay your state or territory government when buying a property. Feedback on our suggestions. Stamp Duty Malaysia On A Loan Agreement Its also important to factor in the stamp duty owed for any loan agreement which may be entered into as part of a property purchase.

The cost of stamp duty depends on the value of the property. Book debts benefits to legal rights and goodwill.

Current Stamp Duty Calculation Hhq Law Firm In Kl Malaysia

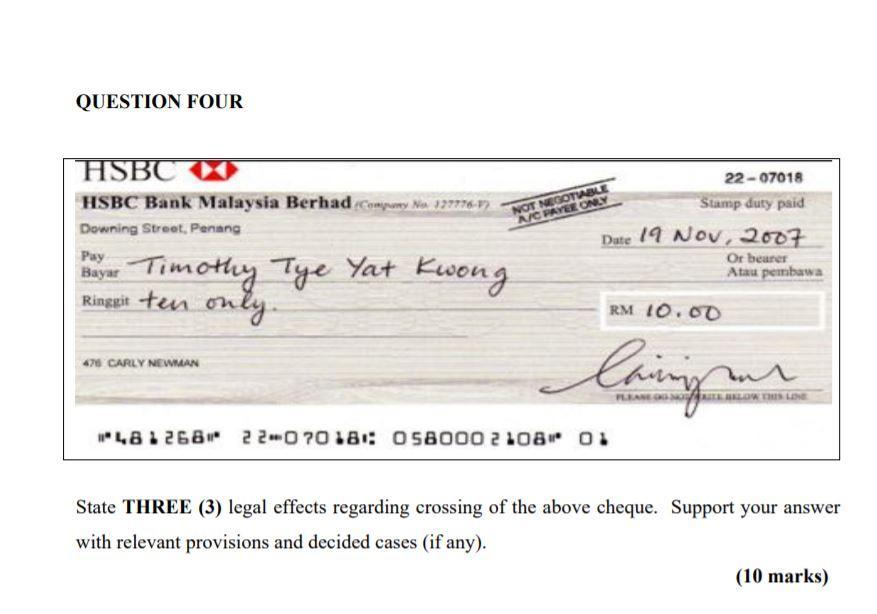

Subject Business Law Analyze The Above Situation Chegg Com

What Is Stamp Duty Everything To Know About Malaysia Stamp Duty

Malaysia Property Stamp Duty Calculation Don T Know How To Count Property Stamp Duty Here Is It By Sheldon Property Facebook

Stamp Duty Malaysia 2022 Commonly Asked Questions Malaysia Housing Loan

Drafting And Stamping Tenancy Agreement

Stamp Duty In Malaysia Everything You Need To Know

Lock Stock Barrel Set Aside Sum For Stamp Duty

Malaysian Stamp Duty Handbook 6th Edition Asia Knowledge Resources

Rise Of Rpgt And Stamp Duty Rate In Malaysia

Malaysia Legal Fees Cal Apps On Google Play

Stamp St Partners Plt Chartered Accountants Malaysia Facebook

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

What Is Memorandum Of Transfer How Does It Work In Malaysia Blog

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Calculate Stamp Duty For Your Tenancy Agreement Malaysia Financial Blogger Ideas For Financial Freedom

Review Budget 2020 Stamp Duty Real Property Gain Tax Ecovis Malaysia

Comments

Post a Comment